Code 1E Offered minimum value coverage to the employee and at least minimum essential coverage to both the dependent children and the spouse An employer that excludes or imposes a surcharge on spouses who have coverage available through the spouse's employer may use this code even if the employee's spouse falls under the carveoutThe IRS has created two sets of codes in order to provide employers with a consistent way to/01/21 · Form 1095C Line by Line Instructions Updated on January , 21 1030am by, TaxBandits IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updated

Aca 1095 C Basic Concepts

What does code 1e mean on 1095-c

What does code 1e mean on 1095-c-Reference Guide for Part II of Form 1095C Lines 14, 15, and 16 (revised for the final 17 forms) November 17 • Lockton Companies L O CKT O N CO M P ANIES GLOSSARY Children means an employee's biological and adopted children (including children placed with the employee for adoption), from birth, adoption, or placement through the end of the month in which the childLine 14 of Form 1095C or Code Series 1 o Displays if employee was offered coverage o Shows whether coverage offered was MEC and MEV or Affordable o Presents which months that coverage was offered o This line is required to have a code for each month or in the "All 12 Months" box

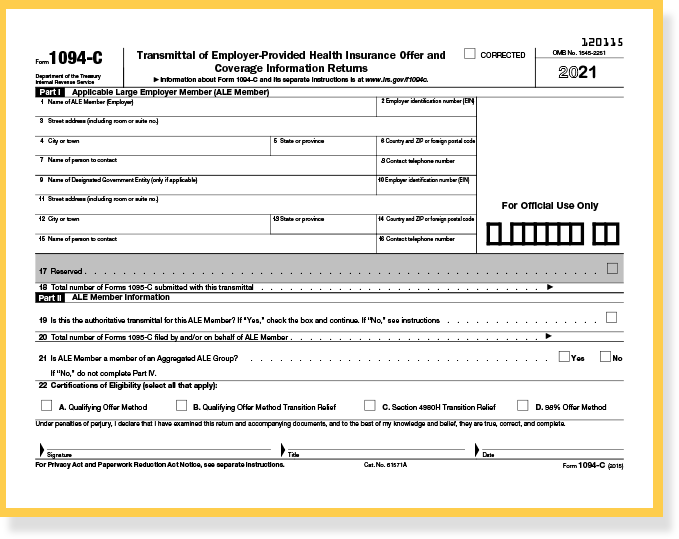

Annual Health Care Coverage Statements

4/02/21 · EBIA Comment This change appears to correct an oversight in the Form 1095C For nonICHRA coverage, line 14 Codes 1B through 1E address the four coverage possibilities for employersponsored minimum essential coverage that provides minimum value employee only, employee plus spouse (no dependents), employee plus dependents (no spouseLine 16 of IRS Form 1095C lists a code that describes, for each month in the previous year, the kind of coverage that an employee enrolled in, and how the employer meets the employer shared responsibility "Safe Harbor" provisions of Section 4980H Below is a description of the various codes in Code Series 2 2A Employee not employed during the month Enter code 2A if theInstead use code 1J 1E Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to dependent(s) and spouse Do not use code 1E if the coverage

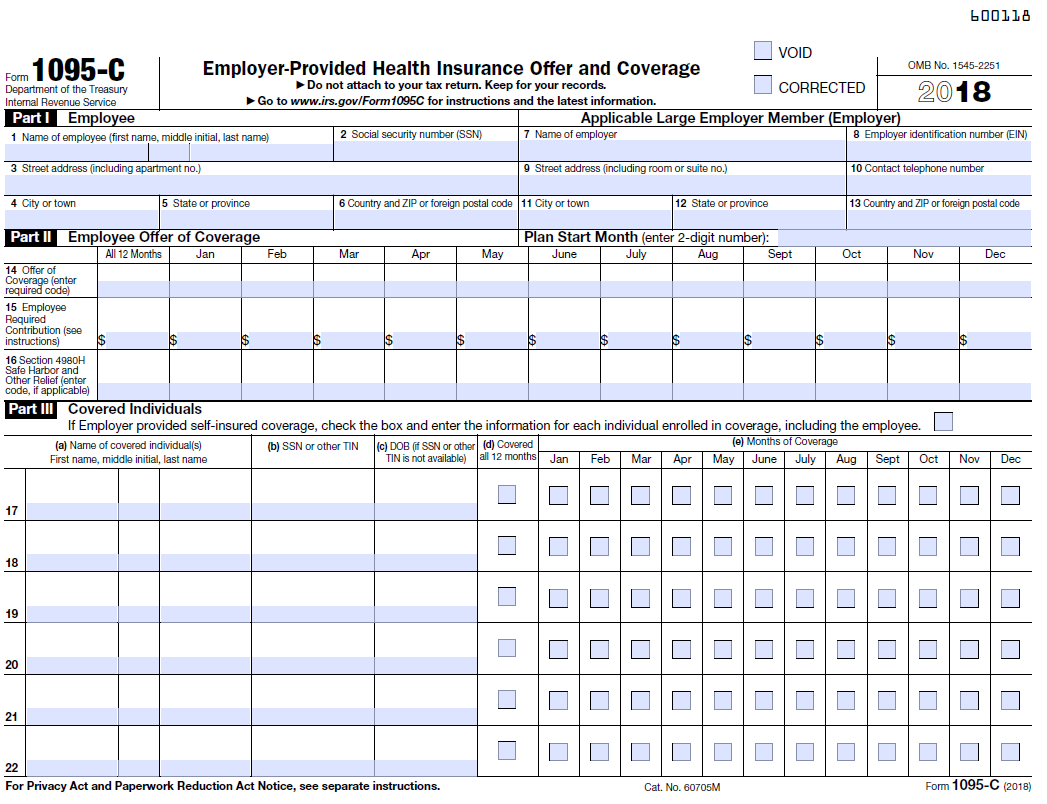

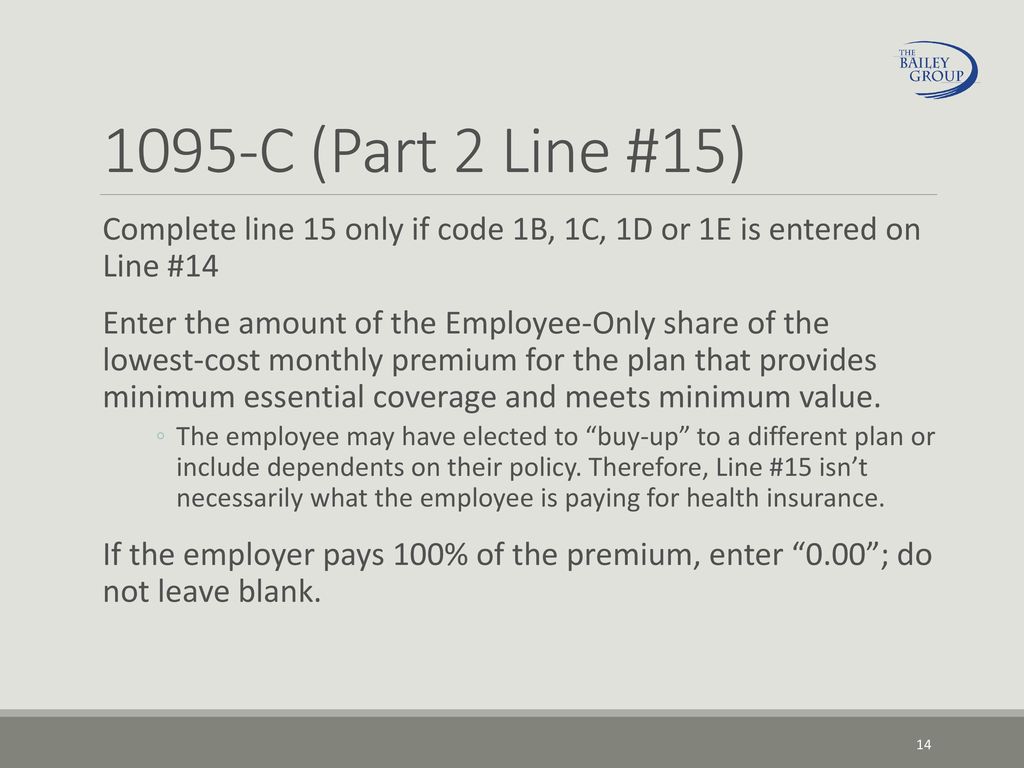

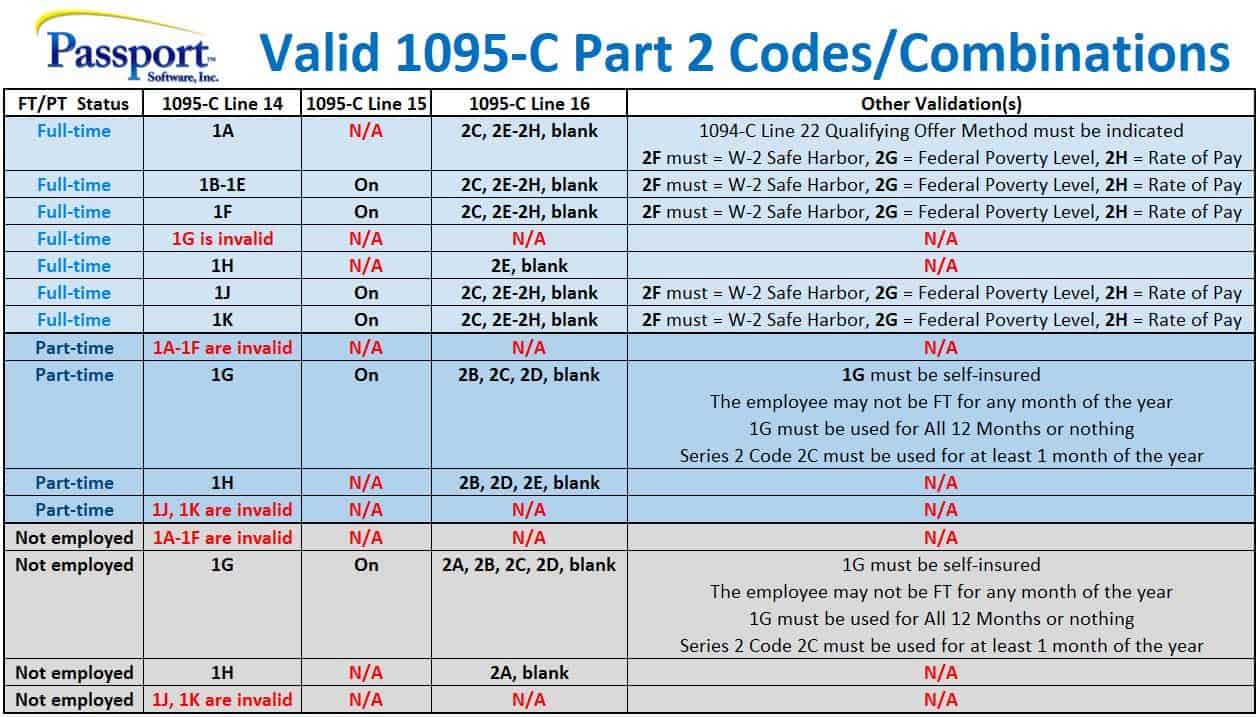

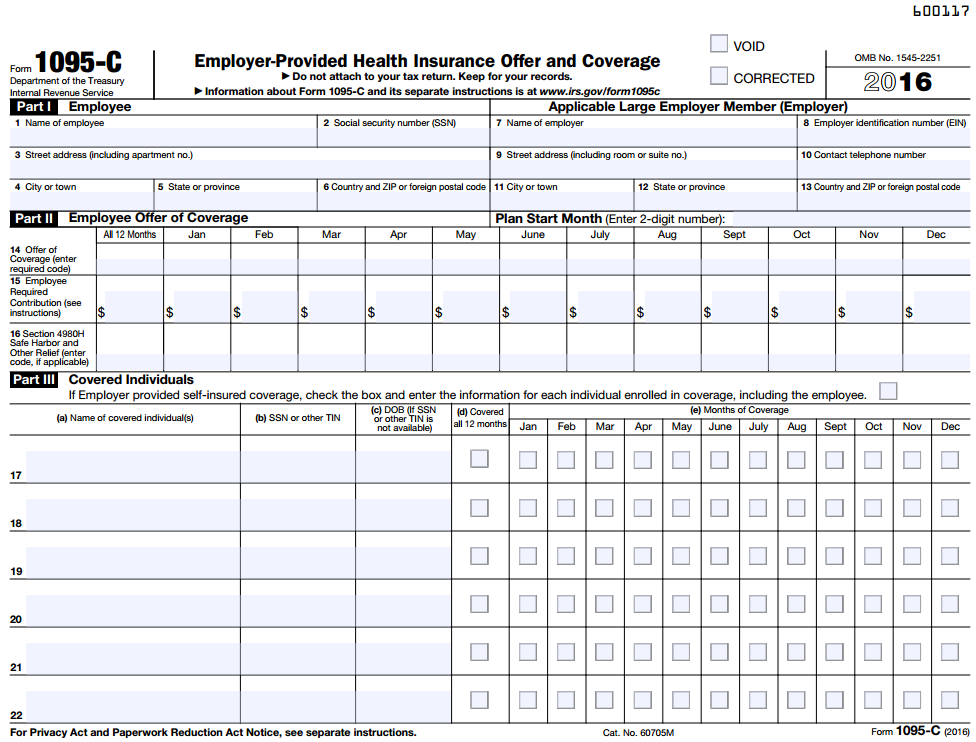

· Below is Form 1095C from the IRS website This guide will explain each piece of the form and help you determine the proper codes for the fields in Part II Shown below in blue, Parts I and III are comprised of lines 113 and 1734, respectively These sections are easy enough, just employee information Part II9/05/18 · Home 18 1095C Codes 18 1095C Codes For more information on how we can support your ACA reporting needs click here Instead use code 1J 1E Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to dependent(s) and spouseOur ACA experts break down all 1095 C codes and walk you through how to fill out lines 14, 15, 16, and 17 and Part III Avoid penalties from the IRS learn the differences between codes!

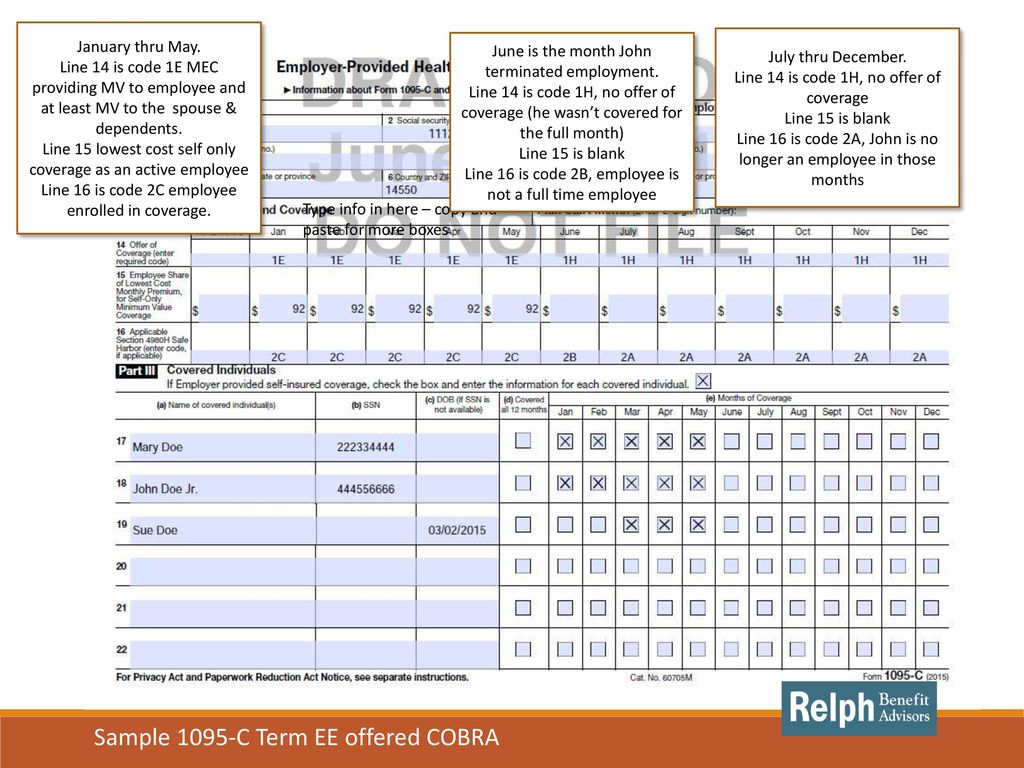

Data, put and request legallybinding electronic signatures Get the job done from any device and share docs by email or fax · Terminated During Reporting Year Report as no offer of coverage – code 1H Reduction in Hours During Reporting Year Report as an offer of coverage – typically code 1B, 1C, 1D, or 1E On SelfInsured COBRA All of Reporting Year Report as an offer of coverage – code 1G Do I need to complete Part III of the 1095C? · ACA Code 1A alert IRS clarifies 1095C guidance for a Qualifying Offer Integrity Data Code 1A alert On January 26, 16, the IRS revised ACA reporting guidance on how employers document a qualifying offer of health coverage on Form 1095C

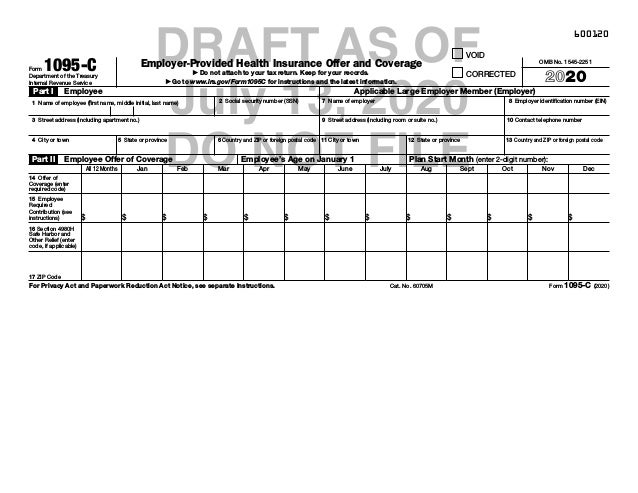

Irs 1095 C Draft Form

Common 1095 C Scenarios

Below is a list of the Offer of Coverage Qualifying Offer Codes that are valid for line 14 on Form 1095C 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with Employee Required Contribution equal to or less than 95% (as adjusted) of mainland single federal poverty line and at least minimum essential coverage offered to spouseForm 1095 C Line 14 Offer of Coverage Line 14 describes the health coverage plan that you offer to your employer, spouse, and other dependents The IRS states 17 codes to enter on line 14 based on the plan offered They are 1A, 1B, 1C, 1D, 1E, 1F, 1G, 1H, 1J, 1K, 1L, 1M, 1N, 1O, 1P, 1Q, and 1SACA 1095C Codes Line 14;

Aca 1095 C Basic Concepts

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Calculating the 1095C Lines 1416 codes is one of the more daunting tasks of ACA reporting For 15 tax reporting, many employers found themselves relying on their "best guesses" to correctly determine and complete their 1095C Part II codes UnifyHR has created a Guide to provide an overview of IRS Form 1095C and the required Part II Codes to empower you with theForm 1095 Code Definitions Lines 14, 15, and 16 Line 14 Offer of coverage code 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for selfonly coverage equal to or less than 95% mainlandNo Form 1095C need be filed for 16 since employee not a fulltime employee B) If employee averaged 30 hours or more during the measurement period, the employee must be offered coverage for the succeeding stability period Assuming the employee enrolls in that coverage, Lines 14 16 of Form 1095C would be completed as follows

Accurate 1095 C Forms A Primer Erp Software Blog

21 Aca Form 1095 C Line 14 16 Code Sheet By Acawise Issuu

Form 1095C is divided into three parts Part I is used to identify the employee, and the reporting ALE entity It includes demographic information such as name, contact and demographic information, Social Security Number (SSN) and Employer Identification Number (EIN) Part II of the IRS Form 1095C includes three significant items Lines 14, 15 & 16These codes are selected in Insurance Plan Setup tab of the ACA Companion ApplicationForm 1095C, employers should consult the Internal Revenue Service's Instructions to Form 1095C for a complete description of the indicator codes • An employer may use 2F, 2G and 2H to indicate that an employee declined an offer of coverage The code an employer uses depends on the reporting method or form of Transition Relief

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Code Series 1 for Form 1095C, Line 14 Updated January 31, 19 For Administrators and Employees Line 14 of IRS Form 1095C lists a code that describes whether an employee was offered coverage by their employer, the type of the coverage offered, and for which months the coverage was offered · Code 1E – Offered minimum value coverage to the employee and at least minimum essential coverage to both the dependent children and the spouse An employer that excludes or imposes a surcharge on spouses who have coverage available through the spouse's employer may use this code even if the employee's spouse falls under the carveoutForm 1095C Lines 14–16 Codes* Line 14 – Offer of Coverage Line 14 specifies the type of coverage, if any, offered to an employee, spouse and dependents The code must indicate the coverage the employee was offered;

The Aca S 1095 C Codes For The Tax Year What Employers Need To Know About The Aca 1095 C Codes

Aca Reporting Tip 11 Employee Waives Coverage Usi Insurance Services

Line Code Logic 14 1A1S Employee is ACA Full Time, either set to Yes by a user, or measured as full time employee based on the ACA hours paid An offer of coverage touches the employee's record for the full calendar month (in the ACA Companion > Employee Plan Details); · Code 1A is a subset of Code 1E, but has to be offered at a low price to be designated as a Qualifying Offer Then, what do the codes on Form 1095 C mean?The Forms 1095C Line 16 Series 2 Codes *Code 2I is no longer used 1095C Line 16 Code 2C • Anything other than a code 1A and 1E on line 14 • Roughly 80% of your employees should have a 1A or 1E but if you see some other codes, you should probably check your data

Aca Code Cheatsheet

How To Accurately Complete Lines 14 16 On Irs Form 1095 C

Minimum essential coverage not offered to dependent(s) (See Conditional offer of spousal coverage, for anRegister for our BernieU course, Intro to Forms 1094C and 1095C, where we cover everything from the code entered on Line 14 (codes 1B1E, 1J1Q) 8 Line 16 For each calendar month, enter the applicable code, if any, from Code Series 2 Enter onlyIRS Form 1095C Indicator Codes for Lines 14, 15, and 16 Form 1095C, Part II, Line 14 Indicator Code Series 1 for "Offer of Coverage" 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for self only coverage equal to or less than 95% mainland single

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Compliance Considerations Covid And 1095 C Reporting Hays Companies

Indicator Codes for Employee Offer of Coverage (Form 1095C, Line 14) Code Series 1—Offer of Coverage Conditional offer of spousal coverageHowever, it may not match the coverage in which the employee is actually enrolled · Tacchino said the indicator codes on lines 14 and 16 in part 2 of the form are by far the most complicated component of Form 1095C Employees may ask what the codes

Understanding Your 1095 C Documents Aca Track Support

1095 C 18 Public Documents 1099 Pro Wiki

· Key Points about completing Form 1095C You have until March 2, 21 to deliver Form 1095C to your employees The codes you use to complete these forms depend on the coverage you offer, whether your employee enrolls, and other employment changes We outline common example scenarios to help you choose the appropriate codes for lines 14 and 161095c codes 18 Take full advantage of a electronic solution to generate, edit and sign contracts in PDF or Word format online Turn them into templates for multiple use, insert fillable fields to collect recipients?5/06/19 · You don't need your 1095C to file your tax return We'll ask you questions about your health coverage but form 1095C isn't needed for those If you were to call the Marketplace and say I have code such and such on my 1095C, they would then be able to say,

Employer Reporting Of Health Coverage Ppt Download

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

8/06/19 · I already filed my return and just received a 1095C form I was employed for January and February of last year and was laid off at the end of February I paid for the state continuation to keep my insurance through my former employer through the end of November I was without insurance for the month of December How would that show on the 1095C?FORM 1095C PART II THE BASICS IMPORTANT NOTE The codes for Line 16 are very complex and depend upon employer and employee specific circumstances The following slides illustrate the use of these codes in common scenarios, but the Form 1095C Instructions should be consulted for possible exceptions or exclusionsHere is how it works Simply select the codes below for lines 14 and 16 below and then press search You will then see the full logic as to why certain code combinations work or do not work

Irs Form 1095 C Codes Explained Integrity Data

The Affordable Care Act S Employer Mandate Part 4 Blog Mma

Form 1095C Line 14–Code Series 1 A Series 1 code must be entered in line 14 to indicate the type of coverage offered (or no coverage offered) to the employee and family Enter a code for each month, or enter one code in the "all 12 months" box if the same code applies for the entire calendar year "Spouse" means the employee's spouse · 1E The 1E code tells the IRS that the employee, their dependents, and spouse received an offer of health coverage that meets Minimum Essential Coverage and Minimum Value The difference between the 1E code and 1A code is that the 1E code may indicate that the offer of coverage was not affordable, or was affordable under the W2 Safe Harbor or Rate of Pay SafeCODES FOR IRS FORM 1095C CODE SERIES 1 (continued) 1J Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage conditionally offered to spouse;

1 0 9 5 C O D E S C H A R T Zonealarm Results

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

1A Minimum essential coverage providing minimum value offered to you with an employee contribution for selfonly coverage equal to or less than 95% of the 48 contiguous states single federal poverty line and minimum essential coverage offered to your spouse and dependent (s) (referred to here as a Qualifying Offer)1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part II, amount only if code 1B, 1C, 1D, or 1E is entered on line 14 If you were offered coverage but not required to contribute any amount towards the premium,Series 1 and Code Series 2 in lines 14 and 16 of Form 1095C The IRS will then review the codes used and determine whether you are compliant with your employer mandate ACA requirements ACA FORM 1095C CODE SERIES The IRS has designed two sets of ACA codes to provide employers with a way to describe health coverage offers on Form 1095C

Sample 1095 C Forms Aca Track Support

Aca Code Cheatsheet

Form 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn moreCode 1E – Offered minimum value coverage to the employee and at least minimum essential coverage to both the dependent children and the spouse An employer that excludes or imposes a surcharge on spouses who have coverage available through the spouse's employer may use this code even if the employee's spouse falls under the carveout10 rijen · Reporting of ICHRA in Line 14 Codes of Form 1095C for On July 13, , the IRS released

1095 C Corrections Support Center

Annual Health Care Coverage Statements

Patient Protection And Affordable Care Act Aca Scott

Clearing Aca Confusion Which Employees Get Irs Form 1095 C

Affordability Safe Harbor Fix Available Datatech

Common 1095 C Coverage Scenarios With Examples Boomtax

The Codes On Form 1095 C Explained The Aca Times

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

Aca Reporting Tip 11 Employee Waives Coverage Usi Insurance Services

Irs Form 1095 C Codes Explained Integrity Data

Common 1095 C Coverage Scenarios With Examples Boomtax

1095 C Reporting Requirements A Step By Step Guide

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Aca Reporting Tip 15 Line 16 Part Time Employees Usi Insurance Services

Common 1095 C Coverage Scenarios With Examples Boomtax

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Common 1095 C Scenarios

Aca Reporting Solution Passport Software Inc

Know The Basics Form 1095 C Justworks

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 C 16 Public Documents 1099 Pro Wiki

Cobra And The Affordable Care Act

Toast Payroll Completing Boxes 14 15 And 16 Of The 1095 C

Affordable Care Act Setup

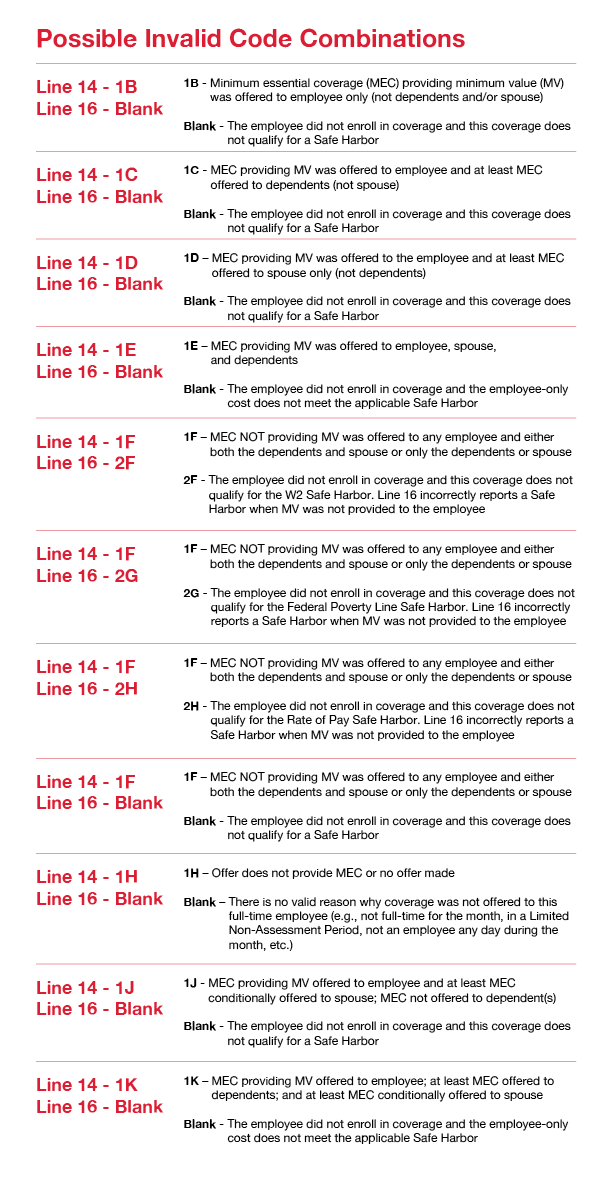

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

Form 1095 C Faq Millennium Medical Solutions Inc

Irs Form 1095 C Codes Explained Integrity Data

Aca 1095 C Basic Concepts

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

Irs Form 1095 C Codes Explained Integrity Data

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Overview Of 1095c Form

Irs Reporting Tip 2 Form 1095 C Line 14 Code 1a Versus 1e And When To Use 1i Innovative Benefits Planning

Form 1095 C Forms Human Resources Vanderbilt University

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Aca Eligibility Tracking Irs Code Section 6055 Ppt Download

Sample 1095 C Forms Aca Track Support

Aca 1095 C Code Cheatsheet

Accurate 1095 C Forms Reporting A Primer Integrity Data

Code Series 1 For Form 1095 C Line 14

Good Sense Guide To Minimum Essential Coverage Forms 1094 C And 1095 C

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

0 件のコメント:

コメントを投稿